CONSUMERS BANCORP, INC. ANNOUNCES FIRST QUARTER FY 2025 EARNINGS

Consumers Bancorp, Inc. Reports:

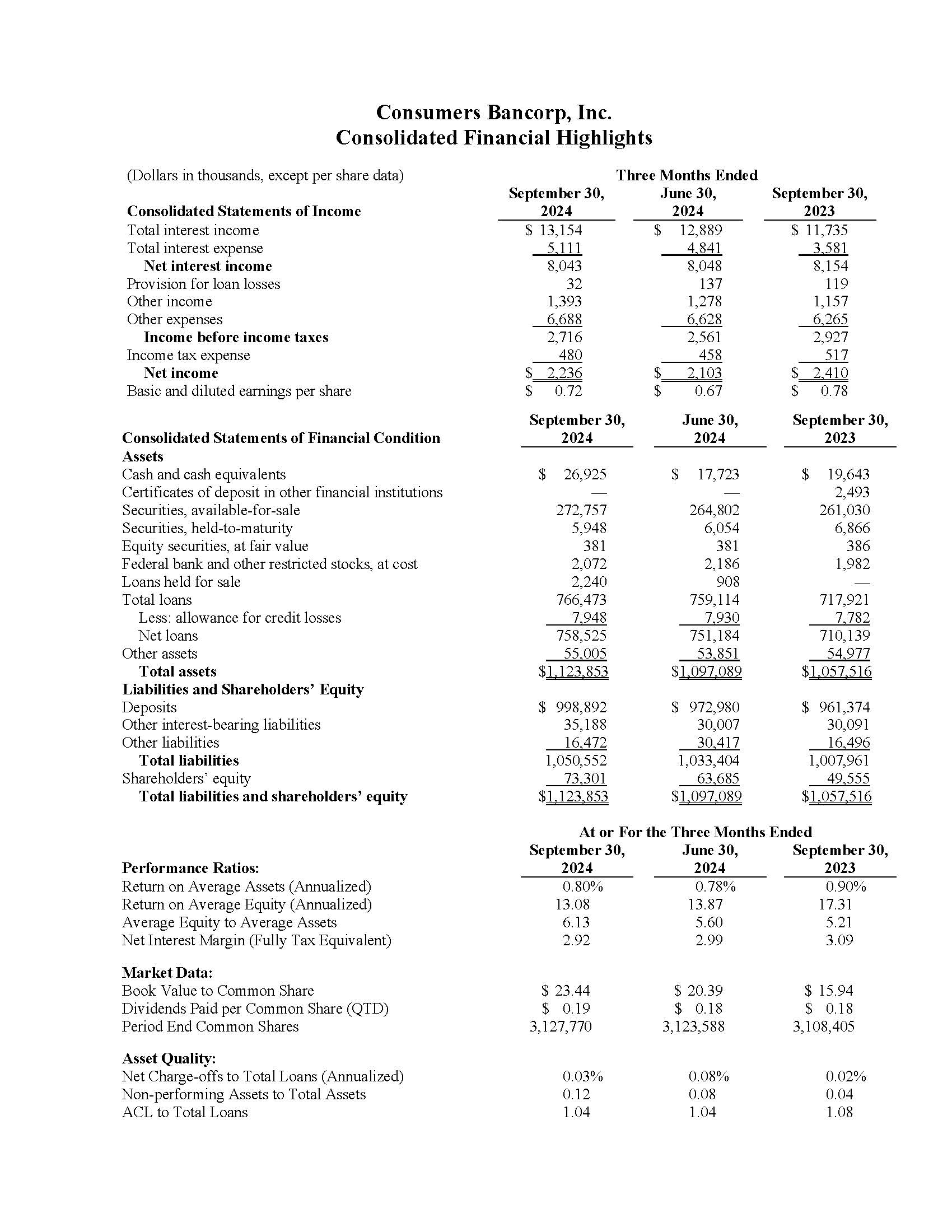

- Net income was $2.2 million for the three-month period ended September 30, 2024.

- Net income increased $133 thousand, or 6.3%, for the three-month period ended September 30, 2024 compared with the quarter ended June 30, 2024.

- Total loans increased by $7.4 million, or an annualized 3.9%, for the three-month period ended September 30, 2024.

- Non-performing loans to total loans were 0.12%, of which 0.05% represents the government guaranteed portion, as of September 30, 2024.

- Total deposits increased by $25.9 million, or an annualized 10.7%, for the three-month period ended September 30, 2024.

- Shareholders’ equity increased by $9.6 million, or $3.07 per share, for the three-month period ended September 30, 2024.

Minerva, Ohio—October 21, 2024 (OTCQX: CBKM) Consumers Bancorp, Inc. (Consumers) today reported net income of $2.2 million for the first quarter of fiscal year 2025, an increase of $133 thousand, or 6.3%, from the quarter ended June 30, 2024. Earnings per share for the first quarter of fiscal year 2025 were $0.72, $0.67 for the quarter ended June 30, 2024, and $0.78 for the same period last year.

“The competitive pressures on deposit pricing that began to lessen during the fourth quarter of fiscal year 2024, eased further because of the 50-basis point cut in the discount rate in September 2024. We have been able to reduce the initial pricing on money market accounts and time deposits. Further, account yields are trending downward as guaranteed money market rate periods expire and time deposits renew at rates lower than the expiring coupons. We expect the cost of funds to trend downward in future quarters as these trends work their way through the respective portfolios. While quarterly loan production remains below previous levels, increases in commercial, mortgage and personal loan activity is reflected in stronger pipelines and resulted in total loan production (portfolio and held for sale) of $43.4 million during the first quarter of fiscal year 2025, an 18.8% increase over the previous quarter. The loan portfolio continues to perform well with low net charge-offs and nonaccrual balances, and very stable total delinquency ratios all point to resilient commercial and consumer borrowers. The discount rate cut and lower yields across the curve also had a positive impact on the market value of the bank’s securities portfolio which, in turn, contributed to a 15.1% increase in shareholders’ equity in the quarter,” said Ralph J. Lober II, President and Chief Executive Officer.

Quarterly Operating Results Overview

Net income was $2.2 million, or $0.72 per share, for the three months ended September 30, 2024, $2.1 million, or $0.67 per share, for the three months ended June 30, 2024, and $2.4 million, or $0.78 per share, for the same prior year period.

Net interest income was $8.0 million for the three-month period ended September 30, 2024 and $8.2 million for the same prior year period. The net interest margin was 2.92% for the quarter ended September 30, 2024, 2.99% for the quarter ended June 30, 2024, and 3.09% for the quarter ended September 30, 2023. The yield on average interest-earning assets was 4.81% for the quarter ended September 30, 2024, compared with 4.81% for the quarter ended June 30, 2024, and 4.45% for the quarter ended September 30, 2023. The cost of funds increased to 2.56% for the quarter ended September 30, 2024, compared with 2.48% for the quarter ended June 30, 2024, and 1.91% for the quarter ended September 30, 2023. The yield on interest-earning assets as well as the cost of funds have been impacted by the rapid increase in short-term market interest rates in 2022 and 2023.

The provision for credit losses was $32 thousand for the three-month period ended September 30, 2024, and included a $77 thousand provision for credit losses on loans and a reduction of $45 thousand to the reserve for unfunded commitments. This compares with a $119 thousand provision for credit losses for the three-month period ended September 30, 2023, which included a provision for credit losses on loans of $40 thousand and a $79 thousand provision for credit losses on unfunded commitments. Net charge-offs of $59 thousand were recorded for the three-month period ended September 30, 2024, compared with $34 thousand that were recorded for the three-month period ended September 30, 2023.

Other income increased by $236 thousand, or 20.4%, for the three-month period ended September 30, 2024, compared to the same prior year period. Other income for the three-month period ended September 30, 2023 included a $79 thousand loss on the sale of lower yielding securities. Excluding the securities loss, other income increased by $157, or 12.7%, for the three-month period ended September 30, 2024, compared with the same prior year period. Other income increased primarily due to debit card interchange income increasing by $65 thousand, or 11.8%, mortgage banking revenue increasing by $35 thousand, or 35.7%, and service charges on deposit accounts increasing by $24 thousand, or 5.6%.

Other expenses increased by $423 thousand, or 6.8%, for the three-month period ended September 30, 2024, compared to the same prior year period. Increases in salaries and benefits, software expenses, and debit card processing expenses all contributed to the increase in other expenses for the three-month period ended September 30, 2024, compared with the same prior year period.

Balance Sheet and Asset Quality Overview

Total assets were $1.12 billion as of September 30, 2024 and $1.10 billion as of June 30, 2024. From June 30, 2024 to September 30, 2024, total loans increased by $7.4 million, or an annualized 3.9%, and total deposits increased by $25.9 million, or an annualized 10.7%.

Total available-for-sale securities increased by $8.0 million to $272.8 million as of September 30, 2024, from $264.8 million as of June 30, 2024. The increase in the available-for-sale securities portfolio from June 30, 2024 to September 30, 2024, was from a $1.8 million net reduction in the portfolio from maturities and principal paydowns that were not reinvested into the portfolio and due to a $9.8 million improvement in the net unrealized mark to market loss. Total shareholders’ equity increased to $73.3 million as of September 30, 2024, from $63.7 million as of June 30, 2024, because of a reduction of $7.8 million in the accumulated other comprehensive loss from the mark-to-market of available-for-sale securities and from net income of $2.2 million for the first quarter of fiscal year 2025 which was partially offset by cash dividends paid of $594 thousand. The total accumulated other comprehensive loss was $20.6 million as of September 30, 2024. Available-for-sale securities and shareholders’ equity were impacted by rapidly rising interest rates during 2022 and 2023 causing the accumulated other comprehensive loss to increase as available-for-sale securities are marked to fair market value. As market interest rates rise, the fair value of fixed-rate securities decline with a corresponding net of tax decline recorded in the accumulated other comprehensive loss portion of equity. This unrealized loss in securities is adjusted monthly for additional market interest rate fluctuations, principal paydowns, calls, and maturities. Consumers has significant sources of liquidity and therefore does not expect to have to sell securities to fund growth and the unrealized losses are not credit related. Therefore, the losses have not and are not expected to be recorded through earnings as the securities values will recover as the securities approach maturity and mature.

Non-performing loans were $919 thousand as of September 30, 2024, of which $359 thousand is guaranteed by the Small Business Administration. Excluding the guaranteed portion, non-performing loans were $552 thousand, or 0.07% of total loans, as of September 30, 2024, and $502 thousand as of June 30, 2024. The allowance for credit losses (ACL) as a percent of total loans was 1.04% as of September 30, 2024 and June 30, 2024.